The Life Planning 101 Podcast

Episodes

Wednesday Jan 28, 2026

Have You Outgrown Your Advisor? (Rebroadcast)

Wednesday Jan 28, 2026

Wednesday Jan 28, 2026

This week, Angela discusses how to determine if you've outgrown your financial advisor. She shares anecdotes and insights to help listeners evaluate their current advisory relationships and understand the importance of holistic financial planning. The episode emphasizes the need for advisors who proactively work with other professionals and offer comprehensive solutions.

Key Takeaways 💡

Communication and holistic advice: An 88-year-old woman was nearly on the verge of running out of money because her advisor wasn't providing adequate communication or a comprehensive financial plan. The advisor was primarily focused on selling investments rather than offering holistic advice tailored to her specific needs, highlighting the importance of finding an advisor who understands your complete financial picture.

Outgrowing your advisor's expertise: An advisor's expertise may become insufficient as your financial situation evolves, even if they are well-intentioned. An advisor in the Form 400 group shared a story about his grandmother, who paid a substantial amount in taxes because her long-time advisor lacked the knowledge to minimize her tax burden, illustrating the need to reassess your advisor's capabilities periodically.

Finding the right advisor fit: Finding the right financial advisor is challenging, as different advisors have varying approaches and specializations. It's crucial to assess whether your current advisor's approach aligns with your needs and whether they can provide comprehensive guidance. The story of Hallie, the dog, and the yellow chair, illustrates how people tend to stick with things that no longer serve them.

Understanding advisor specializations: Different types of advisors, such as CPAs, bankers, insurance agents, and attorneys, have distinct areas of expertise. CPAs excel in taxes and accounting, bankers in banking products, insurance agents in insurance and annuities, and attorneys in law. It's important to recognize these specializations and seek advisors whose expertise aligns with your specific financial needs.

Captive vs. independent advisors: Captive advisors often have quotas to meet, which may influence their recommendations, while independent advisors may still have limitations based on their RIA or broker-dealer. It's important to understand whether an advisor is captive or independent and to consider the potential implications for their advice. Even amazing captive advisors may not be allowed to do a lot of things to help their clients.

Transparency of fees and commissions: Advisors can be paid through fees or commissions, and neither method is inherently bad. Fee-based advisors may be preferable for ongoing management, while commission-based advisors may be suitable for one-time transactions. It's essential to understand how your advisor is compensated to assess potential conflicts of interest and ensure their recommendations align with your best interests.

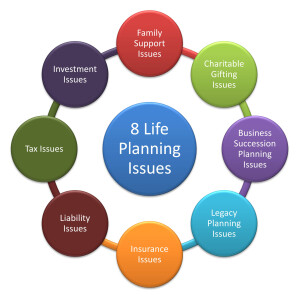

Proactive and holistic planning: A true advisor should proactively work with you and your other advisors to create a holistic life plan. This includes coordinating with insurance agents, accountants, and attorneys to address various aspects of your financial life, such as family support, charitable gifting, business succession, legacy planning, estate planning, liability issues, debt, tax issues, insurance, and investments.

Considering all available options: An effective advisor should make you aware of all available options, even if they don't have expertise in every area. Most advisors don't know everything, so it's important to seek help and advice from multiple sources when needed. If your advisor hasn't made you aware of the topics discussed in the podcast, you probably need to take a sit down and look at your situation.

Thursday Oct 16, 2025

Pocketbook Power Plays

Thursday Oct 16, 2025

Thursday Oct 16, 2025

Inflation has made everything feel tighter—but there are ways to put money back in your pocket. In this episode, Angela shares five practical strategies to help you stretch your dollars without sacrificing your lifestyle:

✅ Reevaluate home and auto insurance✅ Use credit card rewards wisely✅ Make your cash actually earn interest✅ Cut interest costs on existing debt✅ Adjust your tax planning before 2026 hits

Talk is cheap—action saves money. Tune in and start putting these ideas to work today!

Wednesday Oct 01, 2025

Two Reasons You Get Sued (Rebroadcast)

Wednesday Oct 01, 2025

Wednesday Oct 01, 2025

In this episode, Angela discusses the importance of asset protection planning in today's litigious society. She emphasizes that anyone can be sued, regardless of their wealth, and highlights the need for preventative measures to safeguard one's assets. The episode aims to educate listeners on how to create a holistic asset protection plan to mitigate risks and live life on purpose.

Key Takeaways 💡

There are an estimated 40 million lawsuits filed every year in the United States, highlighting the importance of being prepared for potential legal action. It's crucial to consider whether you could afford to defend yourself in a lawsuit and to understand the stress it would cause. Prevention is key, and having preventative measures in place is always a good idea.

An asset protection plan is a foundation for living life on purpose, and without it, individuals are vulnerable to financial loss. It is important to know where you stand, what is at risk, and who to call in case of a lawsuit. Preventative measures do not guarantee that you will not be sued, but they can help you know where you stand and what is at risk.

Many successful people lack a comprehensive asset protection plan, often because their existing professionals focus on their specific areas of expertise without considering the holistic picture. It's essential to have someone quarterback the plan and look at everything holistically to ensure all aspects are covered. Without a holistic asset protection plan, individuals may be exposed to significant financial risks.

Creating a good asset protection plan involves reviewing all assets, how they are titled, income, debt, and insurance policies to ensure they align properly. Many people operate under false assumptions, such as believing they have adequate umbrella insurance or that their trust provides sufficient protection. A revocable trust, for example, offers limited asset protection because the grantor can take the assets back, making them accessible to creditors.

Putting an asset protection plan in place often requires a team effort involving attorneys, insurance agents, accountants, and bankers who are all on the same page. A life planner can help facilitate communication between these advisors to ensure there are no gaps or overlaps in coverage. This holistic approach helps individuals live life on purpose by identifying and addressing potential risks to their financial well-being.

Procrastination, cost concerns, and not knowing where to start are common reasons why people don't have an asset protection plan. However, the time, cost, and stress of being sued can be far greater than the investment in a proactive plan. Planning now can prevent significant financial losses later, emphasizing the importance of taking action to protect one's assets and live LIFE on purpose.

Wednesday Aug 13, 2025

Where Are You Getting Advice?

Wednesday Aug 13, 2025

Wednesday Aug 13, 2025

In this episode, Angela discusses the importance of seeking sound advice and avoiding common pitfalls. She shares humorous anecdotes of bad advice and emphasizes the need to be cautious about the voices influencing our decisions. Angela highlights the significance of having a trusted team of professionals to address various aspects of life planning, including business, finances, and legacy.

Key Takeaways 💡

It is important to be mindful of the sources of advice we receive and how they impact our decisions, not only in faith but also in relationships, raising children, business, and financial matters. There is a lot of advice available on every topic, but it's crucial to discern whether it's accurate and appropriate for your specific situation, especially with the rise of AI and readily available information on the internet.

Relying solely on a single professional, even a trusted one, can lead to gaps and overlaps in financial plans because they may not have a holistic view or the necessary expertise in all areas. It is important to ensure that the professional is equipped with the right tools and knowledge to provide comprehensive guidance, as even well-intentioned professionals can give bad advice if they lack expertise in a particular area.

Bad advice from even skilled professionals can stem from two main reasons: they may not know what they don't know, leading them to offer advice outside their expertise, or the right questions are not being asked, resulting in a limited or biased perspective. For instance, asking a banker how to pay for a business succession plan may lead to solutions involving banking products, while a broader approach might consider tax benefits, insurance, or alternative funding methods.

As financial situations grow more complex, individuals outgrow the need for a single professional and require a team of experts, with a quarterback to lead the charge and coordinate efforts. The role of a life planner is to help individuals define what it means for them to live life on purpose, understand their future goals, current situation, family dynamics, and feelings about risk and money, and then identify the right professionals to involve at the appropriate times.

When seeking advice for business, money, or legacy matters, it's beneficial to consult with a life planner first to help formulate the right questions and avoid costly mistakes down the road. Life planners can help identify holes in financial plans, determine which professionals need to be involved, and ultimately guide individuals towards living life on purpose.

Thursday May 15, 2025

Thinking About Gifting to Your Children?

Thursday May 15, 2025

Thursday May 15, 2025

This week Angela discusses the complexities and risks involved in gifting significant assets to children, such as land or businesses. She emphasizes the importance of proper planning and professional advice to avoid costly tax consequences and unintended liabilities. The episode focuses particularly on the tax implications of gifting versus inheriting assets and the importance of understanding cost basis.

Key Takeaways 💡

Many parents consider gifting significant assets like land, money, or business interests to their children as they age, but often do so without seeking comprehensive advice, which can lead to costly mistakes. Even when advice is sought, it is frequently from professionals who may not have a holistic understanding of estate and tax planning, resulting in overlooked risks.

Gifting assets without proper planning can expose the family to various risks including lawsuits, creditor claims, divorce risks affecting gifted assets, business liabilities of the recipient, and strained family relationships. Additionally, gifting can unintentionally disinherit grandchildren or transfer assets to unintended parties, such as a new spouse of a child’s widow(er).

One of the most significant and common financial pitfalls of gifting assets is the increase in taxes, particularly due to the transfer of the original cost basis to the recipient. When a gifted asset is sold, the recipient pays capital gains tax based on the original purchase price, which can be much higher than if the asset was inherited.

Cost basis is the original value of an asset for tax purposes, usually the purchase price minus any depreciation taken. When an asset is gifted, the recipient inherits the donor’s cost basis, meaning they may face large capital gains taxes upon sale. In contrast, if the asset is inherited after the donor’s death, the cost basis is stepped up to the asset’s fair market value at the time of death, potentially eliminating capital gains tax if sold immediately.

This difference in cost basis treatment between gifting and inheritance can result in significant tax savings if assets are held until death rather than gifted during life. For example, land purchased decades ago often has a very low cost basis compared to its current market value, so gifting it can trigger large capital gains taxes for the recipient upon sale.

Even if the family does not plan to sell the gifted assets, the cost basis remains important for other reasons, such as depreciation recapture on inherited rental properties or equipment. Inherited assets receive a stepped-up basis, allowing heirs to depreciate the asset anew, which can provide substantial income tax savings over time.

Farmers and ranchers may not realize they can depreciate certain components of their land, such as nutrients, which can offer additional tax benefits. This is an often-overlooked opportunity that can improve cash flow and reduce tax burdens across generations.

Angela stresses the importance of not making gifting decisions alone or without thorough professional guidance. While gifting can be beneficial in some cases, it must be done strategically to avoid unintended tax consequences and other risks. There are creative planning strategies available to mitigate these issues, especially in states like Texas.

The podcast concludes with a reminder that tax laws are complex and constantly changing, and that even accountants and tax professionals may not have complete knowledge of all relevant details. Therefore, a holistic life planning approach involving multiple professionals is essential to protect family wealth and minimize tax liabilities.

Wednesday Oct 30, 2024

Family Support Checklist (Rebroadcast)

Wednesday Oct 30, 2024

Wednesday Oct 30, 2024

As a life planning firm, it is our mission to help you take the essential steps needed to face each of life’s stages with confidence and clarity. We were asked if we could compile a list of the things that need to be addressed on every level when you find it necessary to assume physical, emotional, and financial responsibility for your parents.

Monday Aug 26, 2024

Are Your Assets Protected?

Monday Aug 26, 2024

Monday Aug 26, 2024

Are your assets protected? What good is all the hard work it took to build your success if you don’t take the time to protect it? We’re talking asset protection on this week’s episode. Here are some of the most common issues we see.

Wednesday Aug 14, 2024

Have You Outgrown Your Advisor?

Wednesday Aug 14, 2024

Wednesday Aug 14, 2024

I believe one of the hardest things to do is find the “right fit” advisor for you and your family. Because of this, I thought I might take a minute to educate you a little about our industry.

Wednesday Feb 21, 2024

When to Start Planning (Rebroadcast)

Wednesday Feb 21, 2024

Wednesday Feb 21, 2024

Angela was honored to be a guest on the Real Wealth podcast with Jim Silbernagel to share the benefits and pitfalls that could occur when starting a financial strategy later in life. Please enjoy this gem from our archive.

Wednesday Jan 03, 2024

Cybersecurity Tips (Rebroadcast)

Wednesday Jan 03, 2024

Wednesday Jan 03, 2024

This week we take a dive into our archive for this gem. In 2021, IT expert Mike Ahern with Kennedy Computer Solutions joined us as our special guest to share some important fraud prevention tips. You don't want to miss this!

Wednesday Oct 11, 2023

Two Reasons You Get Sued

Wednesday Oct 11, 2023

Wednesday Oct 11, 2023

There are an estimated 40 million lawsuits filed every year in the United States? Could you afford a lawsuit? Can you imagine the stress of getting sued? On this week’s episode, we’re discussing the importance of having a good asset protection plan for you and your family.

Wednesday Sep 27, 2023

The 8 Life Planning Issues

Wednesday Sep 27, 2023

Wednesday Sep 27, 2023

Over 35 years of working in various fields of Life Planning has shown us that most people don’t plan to fail –they just fail to plan. And one reason behind this procrastination is that they are overwhelmed by the complexity of the task and don’t know where to start. We feel it is very important for every family to seek help and take the time to focus on the questions that need to be addressed. I encourage you to be proactive as opposed to reactive and live your life on Purpose!